Understanding the Global Fiber Optic Supply Squeeze

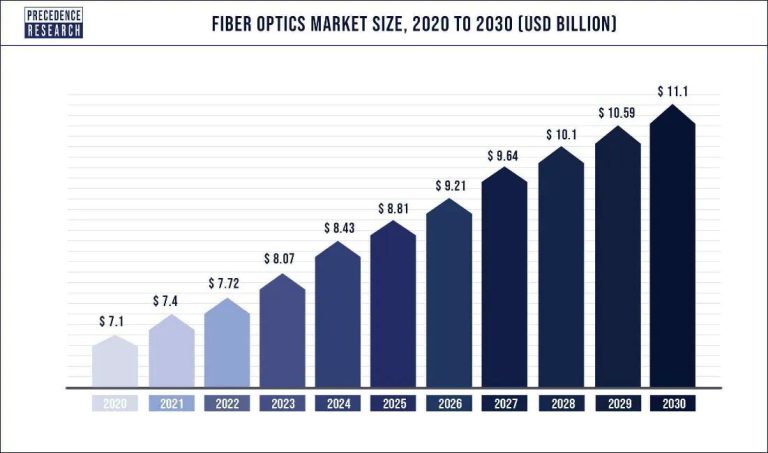

Across the global telecommunications and data infrastructure sectors, a significant challenge has emerged: a structural shortage of core optical fiber types. This isn’t a temporary inventory blip; it’s a deep-seated supply squeeze driven by a confluence of technological evolution, new applications, and rigid production realities. For engineers, procurement managers, and network operators, navigating this difficult landscape requires a clear understanding of the underlying causes and their strategic implications.

The market is currently witnessing unprecedented price volatility and extended lead times, particularly for the industry workhorse, G.652D fiber, and the highly specialized G.657A2 bend-insensitive fiber. This supply-demand imbalance is creating significant downstream risks, impacting project timelines, budgets, and even the pace of critical digital infrastructure rollouts. This article explores the key drivers of this shortage and offers strategic considerations for businesses to maintain project momentum.

The Core Drivers Behind the Shortage

The current fiber deficit is the result of several powerful, intersecting trends that are fundamentally reshaping demand patterns and straining a globally constrained supply chain.

The AI and Data Center Boom

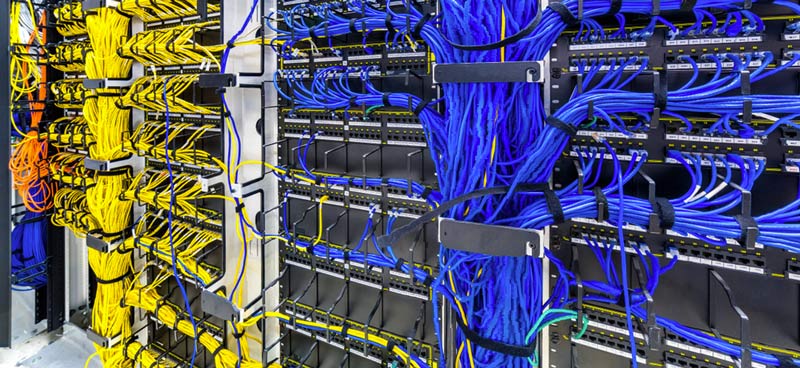

The single greatest new driver of fiber demand is the explosive growth of Artificial Intelligence (AI) and the massive data centers required to power it. An AI cluster with thousands of GPUs requires a staggering amount of internal optical fiber for high-speed interconnects. A single large-scale AI data center can consume several times the fiber of a traditional facility.

This insatiable demand for bandwidth is not only consuming vast quantities of standard G.652D fiber but also driving rapid adoption of high-performance OM5 multimode and G.654.E ultra-low-loss fibers for long-haul data center interconnects (DCI). This surge has absorbed much of the market’s slack capacity, contributing directly to the tight supply of foundational products like Indoor FO Cable and trunking cables like Duct FO Cable used to connect these power-hungry facilities.

Surging Demand from Specialized Applications

Simultaneously, geopolitical events have created a massive, unforeseen demand spike for G.657A2 bend-insensitive fiber. This fiber’s ability to handle tight bends without signal degradation makes it ideal for specialized military and tactical applications, most notably in the tethered fiber optic lines of FPV (First-Person View) drones. In these scenarios, fiber becomes a disposable consumable, with battlefield consumption estimates reaching a significant percentage of total global output.

This has two major effects on the broader market. First, it creates direct competition for G.657A2 fiber, which is also a key component in FTTH Drop Cable used for residential broadband. Second, because G.657A2 is slower to produce than G.652D, it incentivizes manufacturers to allocate their finite production capacity to this higher-margin product, further reducing the available supply of standard fiber.

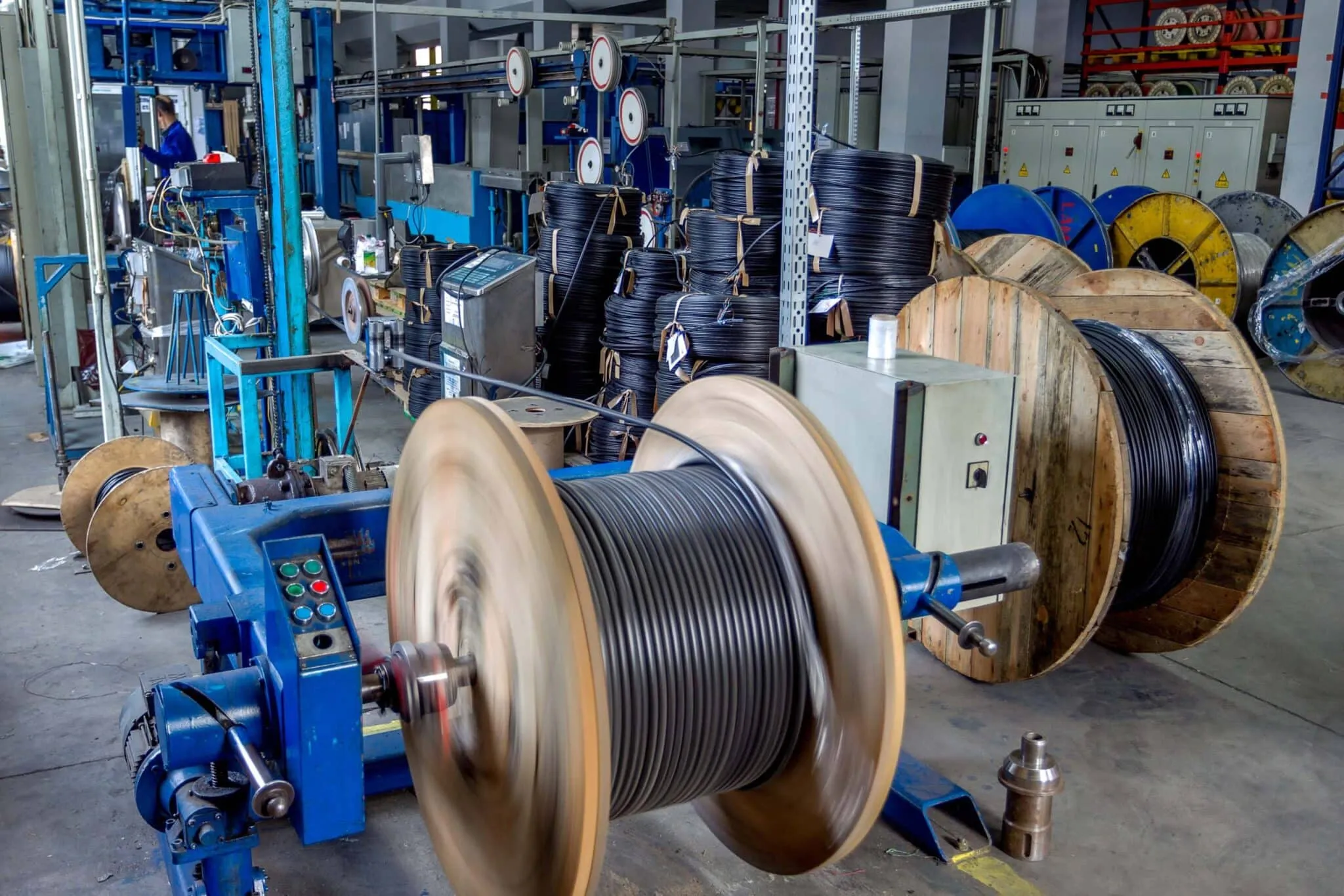

Inelastic Production Capacity

The most critical bottleneck in the fiber optic supply chain is the production of the glass preform—the raw rod from which fiber is drawn. Constructing a new preform manufacturing facility is a capital-intensive process that can take two to three years. Following a period of low prices from 2019, there was little global investment in expanding preform capacity for standard fibers. As a result, today’s production capacity is largely fixed.

With demand surging, manufacturers are operating at or near full capacity. They are strategically shifting this limited capacity toward higher-value products like G.654.E, multi-core fibers, and G.657A2 to maximize profitability. This strategic pivot, while logical from a business perspective, directly squeezes the production of G.652D fiber, leaving many non-integrated cable manufacturers who rely on purchasing fiber on the open market unable to fulfill their orders.

Market Impact and Business Risks

The consequences of this supply imbalance are being felt across the industry, introducing significant risks to project execution and supply chain stability.

Project Delays and Extreme Cost Volatility

The most immediate impact is on project timelines and budgets. Lead times for fiber and cable have ballooned, in some cases doubling from 12 weeks to over 24 weeks. Simultaneously, spot market prices for raw fiber have increased dramatically. This puts contractors and system integrators in a precarious position, where they may be contractually obligated to deliver on projects priced before the cost surge, forcing them to choose between significant financial losses or defaulting on contracts.

Supply Chain Brittleness

The crisis has exposed the fragility of a highly concentrated supply chain. With a few major players controlling the bulk of preform production, any disruption—be it operational, geopolitical, or logistical—can send shockwaves through the entire market. For procurement managers, this highlights the risk of single-sourcing and the critical need for supply chain resilience. Building relationships with vertically integrated manufacturers, who control their production from raw materials to finished cable, can provide a crucial buffer against this volatility. Many companies are now re-evaluating their partners to understand their supply chain depth, a key factor in ensuring project continuity. For more insight into how a vertically integrated model works, you can learn more about our operational philosophy here.

The Danger of Compromising on Quality

In a starved market, there is a tangible risk of lower-quality or counterfeit products entering the supply chain. Desperate to secure materials, some may be tempted to accept cables that do not meet stringent IEC 60794 or other critical performance standards. While this may solve an immediate shortage, installing substandard cable can lead to premature network failure, high maintenance costs, and significant long-term safety and performance liabilities. Upholding strict quality control standards is more important than ever.

Strategic Navigation for a Volatile Market

While the market is challenging, proactive and strategic measures can help mitigate risks and ensure project success.

- Engage in Proactive and Detailed Project Planning: Early and transparent communication with your cable manufacturer is critical. Discuss your project pipeline and forecast demand as far in advance as possible. Explore all viable technical solutions; for example, if a specific Direct Buried FO Cable is facing extreme lead times, a robust ADSS Cable or other Aerial FO Cable design may offer a more readily available and equally effective alternative for your deployment scenario.

- Prioritize Supplier Resilience over Unit Price: In this environment, the lowest initial price can be deceptive if the supplier cannot deliver. The Total Cost of Ownership (TCO), which factors in supplier reliability, delivery assurance, and product quality, is a far more important metric. Partner with manufacturers who can demonstrate a stable supply chain, robust production capacity, and a long-term commitment to the market.

- Diversify and Qualify Your Supplier Base: Relying on a single supplier, especially one without its own fiber production, is a high-risk strategy. Work to qualify and build relationships with multiple experienced manufacturers. A supplier with a diverse portfolio, including not just cables like OPGW and FTTH solutions but also a full range of ODN / FTTH Accessories, is often indicative of a deeper market presence and more resilient supply chain.

The Path Forward

The global fiber optic shortage is a complex issue that will not resolve overnight. It signals a new era for the industry, where demand from AI, modern defense systems, and massive broadband rollouts will continue to test the limits of supply. Success in this new environment requires a shift in procurement strategy—away from a focus on short-term cost-cutting and toward building resilient, transparent, and collaborative partnerships with technically proficient manufacturers.

In this challenging supply environment, open communication and expert consultation are your most valuable assets. To discuss your project’s specific fiber optic requirements and explore robust, reliable cabling solutions, we invite you to contact our engineering team for a detailed consultation.